Exness, undoubtedly, has emerged as the fastest-growing Forex broker globally over the past decade. As the first broker introduced unlimited leverage, Exness has made Forex and gold trading accessible to everyone. However, the unlimited leverage has also rendered Exness as one of the most controversial Forex brokers in the world.

In this article, we will not only explore the details of Exness company profile, its product offerings, and leverage, but also provide insights to help traders evaluate whether Exness is the right fit for their individual needs.

Exness Company Profile

Established in 2008, Exness is headquartered in Limassol, Cyprus. Shortly after its inception, Exness gained popularity in emerging markets due to its high leverage offerings and fast withdrawal processing. With the introduction of unlimited leverage in 2016, it rapidly grew to become one of the largest Forex brokers in the world.

| Regulator | License Number | Regulator | License Number |

|---|---|---|---|

| UK FCA | 730729 | South Africa FSCA | 51024 |

| Cyprus SEC | 178/12 | Kenya CMA | 162 |

Nowadays, Exness employs nearly 2,000 staff across four continents, providing customer support in 15 languages to clients from 180 countries worldwide. The company holds regulatory licenses in the UK, Cyprus, South Africa, and Kenya. Additionally, Exness holds four offshore licenses with Seychelles, the British Virgin Islands, Curaçao and Sint Maarten, and Mauritius.

Who is Fit for Exness Broker

Two major factors have contributed to Exness’s global popularity: high leverage and fast withdrawal processing. Typically, three types of traders find Exness suitable for their needs:

1). Traders Looking For Super-High Leverage

Today, many brokers offer high leverage in the market, however, Exness’s unlimited leverage remains unique. It’s important to note that Exness’s unlimited leverage only applies to Forex, gold, and silver. More details about unlimited leverage will be explained in a separate chapter later.

High leverage doesn’t necessarily mean better, it brings higher risk. For beginners, we highly recommend reading through our article 「What is Leverage in Trading? Unlocking Leveraged Trading」 to understand leverage first.

2). Traders Seeking Lightning-Fast Withdrawal

Exness has automated its withdrawal process, enabling traders to receive funds within 30 minutes after submitting a withdrawal request in many cases. However, Exness does not support bank wire for either deposits or withdrawals.

3). Traders Going After Low Trading Cost

For Forex and gold, Exness offers the best level of trading cost through its professional trading account type, which will be elaborated in detail in the section on account types.

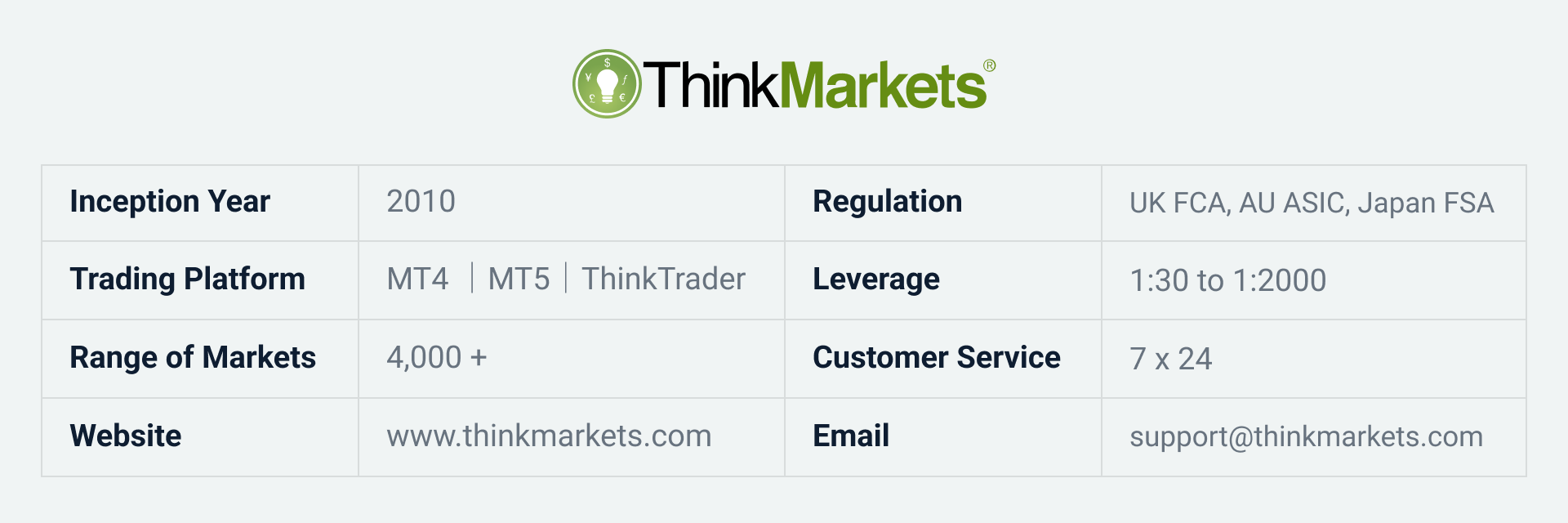

Yet, for crude oil and index traders, Exness might not be the best option. Its trading costs on crude oil and index are significantly higher than those of other low-cost brokers such as ThinkMarkets, INFINOX, and Pepperstone.

Exness Trading Platforms

In contrast to its same-level competitors, Exness does not have its own proprietary trading platform. Instead, it focuses on the popular MT4 and MT5 platforms, with MT5 being its most recommended. Exness provides nearly 500 trading instruments across a range of categories including Forex, metals, crude oil, indices, and cryptocurrencies.

Building upon the MT5 platform, Exness has developed an integrated trading terminal – Exness terminal, which is compatible with web and mobile app. Irrespective of account type, traders can utilize the Exness terminal alongside MT5. For those managing multiple trading accounts, the Exness terminal offers the convenience of swift switching between accounts.

Exness Account Types & Spreads

Exness categorizes its account types into two main groups: standard accounts and professional accounts. Within the standard account category, there is only one account type available, which is the standard account. In contrast, the professional category includes three different account types: Pro Account, Zero Account, and Raw Spread Account.

With the exception of the minimum deposit requirement and trading costs, all four account types share the same trading conditions outlined below:

- Maximum leverage: FX & Gold 2000x | WTI & BRENT 200x | Indices 400x

- Minimum trading lot: FX & Gold 0.01 lots | WTI & BRENT 0.01 lots (10 barrels) | Indices 0.01 lots

- Stop-out level: 0%

Further details regarding the eligibility criteria for accessing unlimited leverage, including trading volume and equity level requirements, will be provided in the following section.

1). Exness Standard Account

| Exnesss Average Spread - Standard Account | ||

|---|---|---|

| Instrument | Average spread | Commission |

| EURUSD | 1 | 0 |

| USDJPY | 1.1 | |

| GBPUSD | 1.2 | |

| XAUUSD | 0.2 | |

| USOIL | 0.056 | |

| UKOIL | 0.11 | |

| US30 | 7.8 | |

| US500 | 1.71 | |

| USTEC | 5.33 | |

Minimum deposit requirement: 0

Trading Fees: Spread

The standard account at Exness does not impose any deposit requirements. Despite this, its spreads on Forex and gold remain highly competitive, comparable to those offered by other well-known low spread brokers.

However, when it comes to trading crude oil and indices, Exness’ spreads are considerably higher than those of other low spread brokers. Therefore, we do not recommend Exness for crude oil and indices trading.

2). Exness Pro Account

| Exness Average Spread - Pro Account | ||

|---|---|---|

| Instrument | Average spread | Commission |

| EURUSD | 0.6 | 0 |

| USDJPY | 0.7 | |

| GBPUSD | 0.8 | |

| XAUUSD | 0.13 | |

| USOIL | 0.035 | |

| UKOIL | 0.07 | |

| US30 | 4.9 | |

| US500 | 1.07 | |

| USTEC | 3.33 | |

Minimum deposit requirement: 200

Trading Fees: Spread

Similar to the standard account, Exness only charges spread on its Pro account. However, the spreads are lower, with a reduction of 0.4 pips on Forex and 0.07 pips on gold compared to the standard account.

When considering the trading costs on Forex, the Exness Pro account stands out as one of the best in the market, surpassing even the other two professional account types.

Despite being more cost-effective than the standard account, the spreads on oil and indices remain significantly higher than those offered by other low spread brokers.

3). Exness Zero & Raw Spread Account

Instrument | Exness Zero Account | Exness Raw Spread Account | ||||

|---|---|---|---|---|---|---|

| Average spread | Commission | Trading Cost Per Lot | Average spread | Commission | Trading Cost Per Lot | |

| EURUSD | 0 | $7 | $7 | 0 | $7 | $7 |

| USDJPY | 0 | $7 | $7 | 0 | $7 | |

| GBPUSD | 0 | $9 | $9 | 0.1 | $8 | |

| XAUUSD | 0 | $16 | $16 | 0.06 | $13 | |

| USOIL | 0 | $35 | $35 | 0.01 | $17 | |

| UKOIL | 0.02 | $65 | $85 | 0.06 | $67 | |

| US30 | 0.7 | $4 | $4.7 | 2.7 | $2 | $4.7 |

| US500 | 0 | $1 | $1 | 0.48 | $1 | $1.48 |

| USTEC | 0.54 | $2.5 | $3.04 | 1.79 | $1.25 | $3.04 |

Minimum deposit requirement: $200

Trading Fees: Spread + commission

The Zero account and Raw Spread account share the same fee structure. To determine which account type is more favorable to traders, a column labeled ‘Trading Cost per Lot’ has been added to the comparison table above. Below is a summary of their differences:

- Zero account: Forex and gold spreads generally stay at 0 most of the time, but the commission charges are higher.

- Raw Spread Account: The spreads are higher compared to the Zero account, but the commission charges are lower.

When combining the spread and commission, the overall trading cost on the Raw Spread account is slightly lower than that of the Zero account.

4). Raw Spread Account VS Pro Account

We know that the trading cost in the Raw Spread account is lower than in the Zero account. The question now is whether it is also cheaper than the Pro account. The answer depends on the trading instrument:

- Forex: The Pro account is better, especially for JPY pairs. For instance, the trading cost is $2.5 lower per lot.

- Gold: The trading cost is almost the same between the Pro and the Raw Spread account.

- Crude Oil & Indices: The trading cost in the Raw Spread account is more favorable.

In conclusion, we recommend the Pro account over the Raw Spread account due to its better costs on Forex. For WTI/BRENT and indices, regardless of the account type, Exness’s trading costs cannot compete with other low-cost brokers such as ThinkMarkets, INFINOX, and Pepperstone.

Exness Unlimited Leverage

1). What is Unlimited Leverage

In leverage trading, traders must deposit a margin to open a higher-value position. For example, with 2000x leverage, the margin for 1 lot of USD/JPY (valued at $100,000) is $50 (100,000/2000). With a trading cost of $5, a trader needs more than $55 in equity to open a 1 lot USD/JPY position.

Under unlimited leverage, traders can open a position as long as they have enough equity to cover the trading cost, with no margin required. For example, for 1 lot of USD/JPY with a trading cost of $5, any trader with equity exceeding $5 can trade it.

2). Unlimited Leverage Requirments

A new trader can initially choose a maximum leverage of 2000x. To unlock unlimited leverage, the following requirements must be met:

- Account equity less than 1,000 USD.

- Complete 10 trades with volume higher than 5 lots.

Once these requirements are satisfied, traders can change the leverage to unlimited in the Exness Personal Area at any time.

Important note: Unlimited leverage is only available for Forex, gold, and silver.

3). Higher Margin Periods

Higher margin is required to open new orders during specific periods, even if the account is set to unlimited leverage. The rules for these higher margin sessions vary depending on the trading instrument. Below are the general rules:

- 3 hours before the market closes and 1 hour after the market reopens.

- 15 minutes before and 5 minutes after high-level economic news releases.

4). Unlimited Leverage Controversy

While unlimited leverage undoubtedly appeals to traders with limited funds, the question remains whether it truly benefits them. For the majority of retail traders, we do not recommend it. Unlimited leverage often encourages traders to open larger positions, which in turn increases their risk exposure.

Consider this scenario: if we were to open a 1 lot position in gold (equivalent to 100 ounces) with only 50 USD equity in the account, the position could be liquidated with a mere 0.5 USD unfavorable fluctuation, a change that could occur in less than a second.

Engaging in such substantial positions with limited equity via unlimited leverage resembles gambling rather than sound financial trading. While there may be professional traders capable of effectively managing unlimited leverage, it is unlikely to yield positive outcomes for the majority of retail investors.

Exness High Margin Sessions

As mentioned previously, new orders opened during specific trading sessions require higher margin, even if the account has unlimited leverage. This complexity arises because the rules vary for different instruments. In this chapter, we will provide detailed explanations of these rules.

The graph on the left illustrates the rule of high margin sessions for Forex pairs. While it is the simplest rule compared to other instruments, the challenge lies in the frequent occurrence of high-impact news in Forex markets.

The timestamp indicated on the graph is GMT+8.

In addition to the news releases and weekend breaks, high margin requirements also apply to gold during its daily break. Please refer to the details in the graph on the left side.

The rules for crude oil and indices are even more complex. For example, during high margin sessions, the maximum leverage is limited to 20x on oil and 50x on indices.

Exness Deposit and Withdrawal

1). Exness Deposit Methods

Exness offers four types of deposit channels as listed below. However, unlike most other brokers, Exness does not provide bank wire deposit option.

(1). Local Bank Transfer

In many emerging countries, Exness provides local bank transfer solution that allows traders to deposit funds in their local currencies. The name and icon of the local bank transfer displayed in the Exness Client Area may vary from country to country, but they will be presented as the first option in the deposit section.

(2). Credit Card / Debit Card

Exness supports Visa, Mastercard, and JCB cards, which are displayed as the “Bank Card” deposit option in the Client Area. However, some issuing banks may have restrictions on these types of card transactions. Therefore, local bank transfers and crypto deposits are more recommended.

(3). E-wallets

Exness supports popular e-wallets including Skrill, Neteller, and SticPay.

(4). Cryptocurrencies

Crypto is the recommended deposit option, Exness accepts USDT, Bitcoin, and USC.

2). Exness Withdrawal Methods

Exness is one of the first brokers to adopt automated withdrawal process. For withdrawal through local bank transfer and crypto, traders can often receive funds within 30 minutes in many cases. Credit card withdrawals typically take 1-3 business days for processing. Exness even allows traders to withdraw profits to their credit cards.

Additionally, Exness charges no fees on all types of withdrawals, but it follows the rule of returning funds to the original deposit method and do not accept third-pary withdrawals.

Exness Signup & Verification Steps

It only takes about 10 minutes to sign up for a live account with Exness. Note: Exness doesn’t provide trading services to American and Malaysian residents.

The signup process involves three verification steps, as shown on the graph. Traders are allowed to deposit and trade right away upon completion of the first step. However, a $2,000 deposit limit is in place until further verification is completed.

Once proof of ID and proof of residence are verified, all restrictions will be removed.