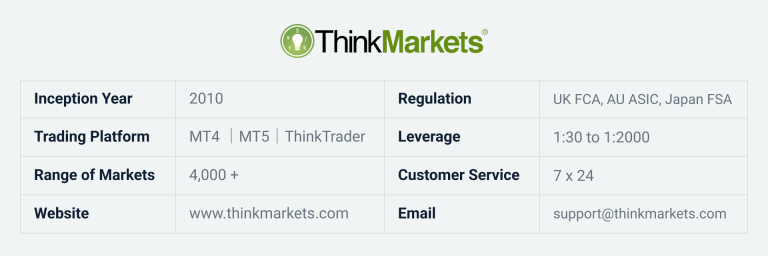

ThinkMarkets stands out as one of the most discussed Forex & CFD brokers online, renowned for its low trading costs and exceptional client service. Setting itself apart from many other brokers offering low spreads with only offshore licenses, ThinkMarkets holds licenses in multiple major finance centers.

In addition to offering the standard MT4 and MT5 platforms, ThinkMarkets also provides its proprietary trading platform, ThinkTrader – integrated with TradingView, granting its clients access to over 4000 global markets, including equities, FX, gold, crude oil, and indices.

History and Regulation of ThinkMarkets

Established in 2010 with a solid operating history spanning 15 years, ThinkMarkets began its journey in New Zealand under the brand ThinkForex. In 2012, it relocated its headquarters to Melbourne after obtaining the license from Australian Securities and Investments Commission.

In 2015, following the acquisition of a UK FCA license and a rebranding to ThinkMarkets, the company embarked on a rapid global expansion. This expansion included the acquisition of new licenses and the establishment of offices in South Africa, Japan, and Dubai.

Currently, ThinkMarkets holds seven tier one finance licenses across different countries and three offshore licenses in the Cayman Islands, Bermuda, and St. Lucia.

| Regulator | License Number | Regulator | License Number |

|---|---|---|---|

| Australian ASIC | AFSL412816 | Cyprus SEC | 215/13 |

| UK FCA | FRN629628 | South Africa FSCA | FSP49835 |

| Japan FSA | 0250 | New Zealand FMA | FSP623289 |

| Dubai FSA | #F004173 | ||

What Types of Traders Suited for ThinkMarkets

ThinkMarkets is well-known for its low trading costs. In addition to its robust global regulation, another factor that sets it apart from other low-cost brokers is its competitive pricing across most major assets. Using its ThinkZero account as an example, we will demonstrate its trading costs across different asset classes:

- Forex: The trading costs are just $7 per lot on major pairs including EUR/USD and USD/JPY.

- Gold: It only costs $15 to trade 1 lot of spot gold on average.

- Crude oil: The spread on WTI/Brent is just 0.03, equivalent to $3 per 1 lot (100 barrels).

- Indices: US30 spread – 1.4, SPX500 spread – 0.4, NAS100 spread – 1.2.

Although Forex and gold are the most mentioned products for ThinkMarkets, its trading costs on indices are actually among the lowest in the market, making it an ideal broker for index traders as well. Furthermore, traders with large funds and high trading volumes can negotiate with ThinkMarkets to reduce costs further.

In summary, for traders seeking consistently low costs across multiple markets on one platform, ThinkMarkets is one of the best choices. Additionally, for fans of TradingView charting, ThinkMarkets has seamlessly integrated TradingView into its proprietary ThinkTrader platform, maintaining the same level of trading costs as the ThinkZero account.

ThinkMarkets Trading Platform & Market Range

ThinkMarkets offers three distinct trading platforms, which include the widely-used MT4 and MT5. In addition, it provides its proprietary platform, ThinkTrader, which is equipped with the most popular TradingView charting.

Each of these trading platforms offers a different range of markets. Below is a brief introduction to each:

MT4 Platform

Market range: 47 currencies, 7 metals, 18 indices, 7 commodities, 20 cryptos, 7 futures, 65 US equity CFDs, and 39 Australian equity CFDs.

EA trading: support | Scalping trading: support

Supporting devices: Windows, mobile, and web

MT5 Platform

Market range: 47 currencies, 5 metals, 18 indices, 7 commodities, 20 cryptos, 7 futures, 27 HK equity CFDs, 49 Australian equity CFDs, and over 1,000 US equity CFDs

EA trading: support | Scalping trading: support

Supporting devices: Windows, mobile, and web

ThinkTrader Platform

Market range: 47 currencies, 5 metals, 23 indices, 5 commodities, 27 cryptos, and over 3,500 equity CFDs and ETF CFDs.

EA trading: support | Scalping trading: support

Supporting devices: Web and mobile

Featured functions:TradingView charting, Trading Signal, Backtesting

ThinkMarkets Account Type, Spread & Leverage

1). MT4/MT5 Standard Account

| Averaged Spread in ThinkMarkets Standard Account | ||

|---|---|---|

| Instrument | Averaged spread | Commission |

| EUR/USD | 1.1 | 0 |

| USD/JPY | 1.4 | |

| XAUUSD | 0.2 | |

| WTI | 0.03 | |

| BRENT | 0.03 | |

| US30 | 1.2 | |

| SPX500 | 0.4 | |

| NAS100 | 0.8 | |

Platform:MT4 | MT5

Max Leverage:FX: 500x | Gold: 400x | Index: 200x | WTI/BRENT: 100x | BTC: 50x | US equities: 10x

Min Trading Lot:FX: 0.01 lots | Gold: 0.01 lots (1 ounce) | WTI/BRENT: 0.1 lots (10 barrels) | Index: 0.1 lots

Min Deposit:200 USD

Stopout Level:50%

Trading Fee Structure: Spread only

Although the standard account at ThinkMarkets doesn’t feature the lowest spread, it remains more competitive than many other brokers. This account is well-suited for traders accustomed to using MT4/MT5.

2). MT4/MT5 ThinkZero Account

| Averaged Spread in ThinkMarkets ThinkZero Account | ||

|---|---|---|

| Instrument | Averaged spread | Commission |

| EUR/USD | 0 | $7 per lot |

| USD/JPY | 0 | |

| XAUUSD | 0.8 | |

| WTI | 0.03 | 0 |

| BRENT | 0.03 | |

| US30 | 1.2 | |

| SPX500 | 0.4 | |

| NAS100 | 0.8 | |

Platform:MT4 | MT5

Max Leverage:FX: 500x | Gold: 400x | Index: 200x | WTI/BRENT: 100x | BTC: 50x | US equities: 10x

Min Trading Lot:FX: 0.01 lots | Gold: 0.01 lots (1 ounce) | WTI/BRENT: 0.1 lots (10 barrels) | Index: 0.1 lots

Min Deposit:500 USD

Stopout Level:50%

Trading Fee Structure: Raw spread + commission for FX, gold and silver, spread only for others.

For MT4/MT5 traders seeking low trading costs, the ThinkZero account is the top choice. The spread on EURUSD and USDJPY often remains at 0. Compared to the standard account, the ThinkZero account offers an overall reduction in trading costs of $4 per lot for FX.

3). MT4/MT5 Mini Account

| Averaged Spread in ThinkMarkets Mini Account | ||

|---|---|---|

| Instrument | Averaged spread | Commission |

| EUR/USD | 2.5 | 0 |

| USD/JPY | 3.6 | |

| XAUUSD | 3.0 | |

| WTI | 0.06 | |

| BRENT | 0.06 | |

| US30 | 2.5 | |

| SPX500 | 0.9 | |

| NAS100 | 2.8 | |

Platform:MT4 | MT5

Max Leverage:FX: 2000x | Gold: 500x | Index: 500x | WTI/BRENT: 200x | BTC: 50x

Min Trading Lot:FX: 0.01 lots | Gold: 0.01 lots (1 ounce) | WTI/BRENT: 0.1 lots (10 barrels) | Index: 0.1 lots

Min Deposit:10 USD

Stopout Level:25%

Trading Fee Structure: Spread only

With dynamic leverage, the ThinkMarkets Mini account provides up to 2000x leverage on major currencies, 500x on gold & indices, and 200x on WTI/BRENT, making it suitable for traders with limited funds.

4). ThinkTrader Account

| Averaged Spread in ThinkMarkets ThinkTrader Account | ||

|---|---|---|

| Instrument | Averaged spread | Commission |

| EUR/USD | 0.8 | 0 |

| USD/JPY | 1 | |

| XAUUSD | 0.2 | |

| WTI | 0.03 | |

| BRENT | 0.03 | |

| US30 | 1.2 | |

| SPX500 | 0.4 | |

| NAS100 | 0.8 | |

Platform:ThinkTrader

Max Leverage:FX: 500x | Gold: 400x | Index: 200x | WTI/BRENT: 100x | BTC: 50x | US equities: 10x

Min Trading Lot:FX: 0.01 lots | Gold: 0.01 lots (1 ounce) | WTI/BRENT: 0.1 lots (10 barrels) | Index: 0.1 lots

Min Deposit:no requirement

Stopout Level:50%

Trading Fee Structure: Spread only

Like the standard account, the ThinkTrader account only applies spread charges. However, its trading costs are as low as those of the ThinkZero account.

ThinkTrader platform boasts over 4,000 markets and seamlessly integrates with TradingView charting. It’s a great choice for self-directed traders.

ThinkTrader Account

We briefly introduced the ThinkTrader account in the previous chapter. In fact, ThinkTrader is a highly recommended platform with a number of unique features. In this session, we will explore the details of the ThinkTrader platform. However, please note that ThinkTrader does not support EAs, so EA traders may disregard it.

1). ThinkTrader Trading Costs

Traders will only be charged the spread when trading on ThinkTrader. The real-time spread is displayed directly in the pricing window.

- Indices & Crude Oil: Trading costs are the same as the ThinkZero.

- Gold: Same as the Standard account, averaging $20 per lot.

- FX: EUR/USD average spread 0.9 pips, 1 pip on USD/JPY and GBP/USD.

The Forex cost on ThinkTrader is slightly higher than the ThinkZero but lower than the Standard account. However, it is even cheaper than ThinkZero on JPY pairs. For example, the USD/JPY trading cost in ThinkZero is $7 per lot, while its spread on ThinkTrader is 1 pip – equaling $6.4 per lot.

2). TradingView Charting Integration

TradingView charting is another selling point in addition to the low trading cost. ThinkTrader account holders can use the premium charting features, including 100+ technical indicators, multiple chart displays, and symbol comparison, for free.

3). ThinkTrader Additional Features

(1). Traders Gym Backtest Tool

Traders Gym is a unique backtesting tool available exclusively to ThinkTrader live account holders. While it is not designed for EA backtesting, it allows traders to replay historical chart data and trade as if in a live environment on over 4,000 instruments. In the Traders Gym, traders can set up the instrument, chart timeframe, backtesting period, and playback speed in just a few clicks.

(2). Signal Centre & Economic Calendar

ThinkMarkets has integrated Signal Centre into the ThinkTrader platform. This feature offers real-time trading signals with detailed analysis, including entry and exit prices for reference. Additionally, the economic calendar is directly available within the ThinkTrader platform, allowing traders to check the release time and results for global economic data.

(3). In-Platform Deposit & Withdrawal

Instead of logging into a separate client portal, traders can make deposits, withdrawals, and internal transfers directly from the platform by simply clicking the Funds icon in the navigation bar.

ThinkMarkets Deposit & Withdrawal Methods

1). ThinkMarkets Deposit Methods

(1). Bank Wire

Investors are required to transfer funds to ThinkMarkets’ Clients Funds Account at Barclays London.

Applicable countries: All

Processing time: 1 – 3 business days

Fees: Approx. $15 – $25

In addition to the fees charged by the remitting bank, there may be an additional charge from intermediary banks for international bank transfers. Depending on the bank, the transfer may take 1 to 3 business days to arrive.

(2). Apple/Google Pay

ThinkMarkets supports Apple Pay and Google Pay. Traders will see the option upon logging into the ThinkMarkets client portal from a device with Apple Pay or Google Pay installed.

Applicable countries: Countries that support Apple/Google pay

Processing time: Instant

Fees: No

Apple/Google Pay is a perfect option for deposits less than $10K.

(3). Visa/Master Card

Applicable countries: Most countries and regions

Processing time: Instant

Fees: No

It is recommended to use Apple/Google Pay as the primary option, as some banks may not support this type of credit card transaction.

(4). Cryptocurrency

ThinkMarkets accepts cryptocurrency deposits, supporting 12 cryptocurrencies, including USDT. For traders with a crypto wallet, this is the preferred deposit method, regardless of the deposit amount.

Applicable countries: All

Processing time: Instant

Fees: No

(5). Skrill/Neteller/Perfect Money

Those traditional e-wallets, such as Skrill, Neteller, and Perfect Money, are supported by ThinkMarkets.

Applicable countries: All

Processing time: Instant

Fees: No

(6). Local Bank Transfer

ThinkMarkets offers local bank transfer solution in most emerging countries, allowing traders to deposit funds in their local currency.

Applicable countries: Philippines, Thailand, Vietnam, etc.

Processing time: Instant

Fees: No

2). ThinkMarkets Withdrawal Methods

In compliance with Anti-Money Laundering regulations, ThinkMarkets adheres to the rule of returning funds to the original source for withdrawals. Profits will be sent via bank transfer to the bank account under the same holder’s name. The following examples illustrate this rule:

Withdrawal example one

Deposit $2K by Visa card, request full withdrawal after making $1K profit.

$2K will be returned to the same Visa card used in deposit, and the remaining 1K will be sent by bank transfer.

Withdrawal example two

Top up $3K by USDT, submit full withdrawal request after profiting $2K.

$3K will be send back to the same crypto wallet used in deposit, and another 2K will be processed by bank wire.

ThinkMarkets does not charge any withdrawal fees. However, fees may be incurred depending on the payment processors. For instance, international bank transfers may incur a $15 intermediate bank fee.

| ThinkMarkets withdrawal methods, fees, and processing time | ||

|---|---|---|

| Method | Fees | Processing time |

| Visa/Master Card | No Fees | Withdrawals via credit card and Apple/Google Pay are processed as refunds, with processing times varying depending on the bank, typically ranging from 1 to 10 business days. |

| Apple/Google Pay | No Fees | |

| Bank Transfer | Approx. $15 | 1 - 3 business days |

| Cryptocurrency | No Fees | 1 - 3 business days |

| Skrill/Neteller/Perfect Money | No Fees | 1 - 3 business days |

ThinkMarkets Account Opening Process & Requirement

1). ThinkMarkets Account Opening Requirement

Traders must be at least 18 years old to apply for a live account with ThinkMarkets. A proof of identity will be required for verification purposes. Common forms of proof of identity include the following documents:

- Identity card

- Passport

- Driving license

ThinkMarkets does not provide services to residents of the United States, Canada, Malaysia, and Iran. Malaysian traders can choose other low spread brokers such as INFINOX and Pepperstone.

2). ThinkMarkets Account Opening Process

(1). Online Application Section One

The entire account opening process can be completed online in approximately 5 to 10 minutes. The online application consists of two sections. The first section comprises fixed steps, requiring only basic personal information.

Applicants are prompted to set a password in the first step, which serves as the password for accessing the client portal. For ThinkTrader accounts, this password is also used to log in to the ThinkTrader platform.

Step 1

Step 2

Step 3

Step 4

Step 5

Step 6

Once Step Six is completed, your live account will be created and ready for immediate funding. Your account credentials will be sent to the registered email address. If you have your proof of ID ready, select ‘Complete Account Verification’ and follow the instructions.

Alternatively, you can deposit and start trading right away. However, there will be a total deposit limit of $10,000 in place until the account is successfully verified.

(2). Online Application Section Two

In section two, there are three steps that typically take about five minutes to complete. After providing your address and trading experience, the final step is account verification. Once you upload your proof of ID, the automated verification process will begin.

If your ID is successfully verified, you will receive a confirmation message. Otherwise, further review will be required, and you will receive the update within 1-2 days by email.

Step 7

Step 8

Step 9